Universal Music Group (UMG) parent Vivendi is now considering a behemoth Wall Street public offering. But that’s just one of several tasty possibilities ahead.

Universal Music Group (UMG) could potentially fetch a $40 billion valuation on Wall Street — and they’re saying it out loud. Of course, $40 billion is just back-of-the-envelope calculation by Vivendi, which owns UMG. But given the company’s solid position in a surging music industry ecosystem, it’s a plausible peg.

The question is: will Vivendi go that route?

During its first quarter investor meeting, Vivendi hedged its bets. At this stage, it’s all about exploratory committees and vague possibilities.  In fact, here’s how they opened their financial report on UMG:

“Vivendi’s Supervisory Board approved the Management Board’s proposal notably to examine and carry out the necessary preliminary legal operations required for a potential change in the Universal Music Group’s shareholding structure.  Thereafter, the Management Board will present the various options for such an evolution.â€

So what is that ‘evolution,’ exactly?

Vivendi CEO Arnaud de Puyfontaine says a sale isn’t happening. But he did offer three other possibilities: a partial IPO, a sale of a percentage to an outside party, or a broader partnership. All of which is perfectly vague and cryptic, but at least narrows things down a bit.

Interestingly, that ‘partnership’ could be Spotify. At present, UMG has not divested its 3-4% stake in the streaming giant, and Vivendi says it is unlikely to dump its shares. The other major labels, Sony Music Entertainment and Warner Music Group, have already cashed out a giant percentage of their ownership, while indie consortium Merlin has liquidated all of its holdings.

Meanwhile, the financial picture at UMG is solid and growing.

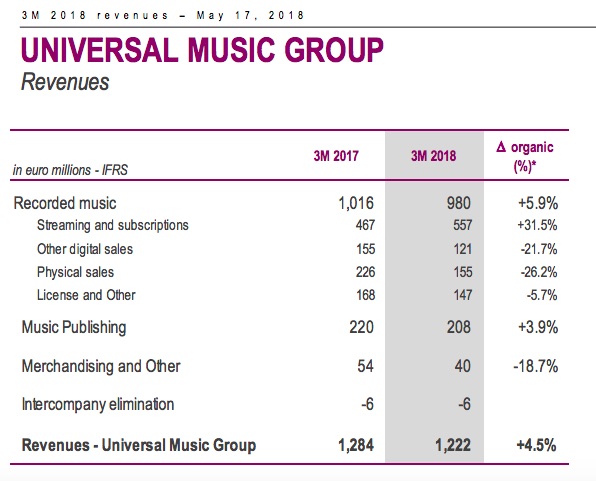

For the first quarter, UMG

reported revenues of 1.22 billion euros ($1.44 billion), a 4.5% increase on a constant currency basis. As you can see below, streaming was a huge part of that growth.

Vivendi further declared that UM

G’s valuation is higher than Spotify’s. But is it?

Spotify remains a profitless company, but a Wall Street success story. But baked into Spotify’s approximate valuation of $25 billion is a huge expectation for future industry dominance — rational or otherwise. Call it the Amazon effect, but Wall Street’s valuation isn’t rooted in Spotify’s ridiculously-bad margins and money-hemorrhaging balance sheets. It’s based partly on hype, which has a funny way of going poof when markets get turbulent.

UMG, on the other hand, has a far more solid business. Indeed, this is a company that technically goes back to the 30s, with an actual business model and seriously valuable assets. Those assets include an incredibly powerful recording and publishing catalog that is critical to Spotify’s success, and explains the massive percentages Spotify pays to use it.

But that doesn’t mean UMG is worth more than Spotify on the open markets. It really depends on a lot of factors, including the level of sizzle that UMG brings to an IPO. Of course, Spotify successfully leveraged its insane tech-music sizzle to mint a $25 billion valuation.

Could UMG muster that same level of hype and ‘irrational exuberance’?

Source: Digital Music News